All Categories

Featured

Table of Contents

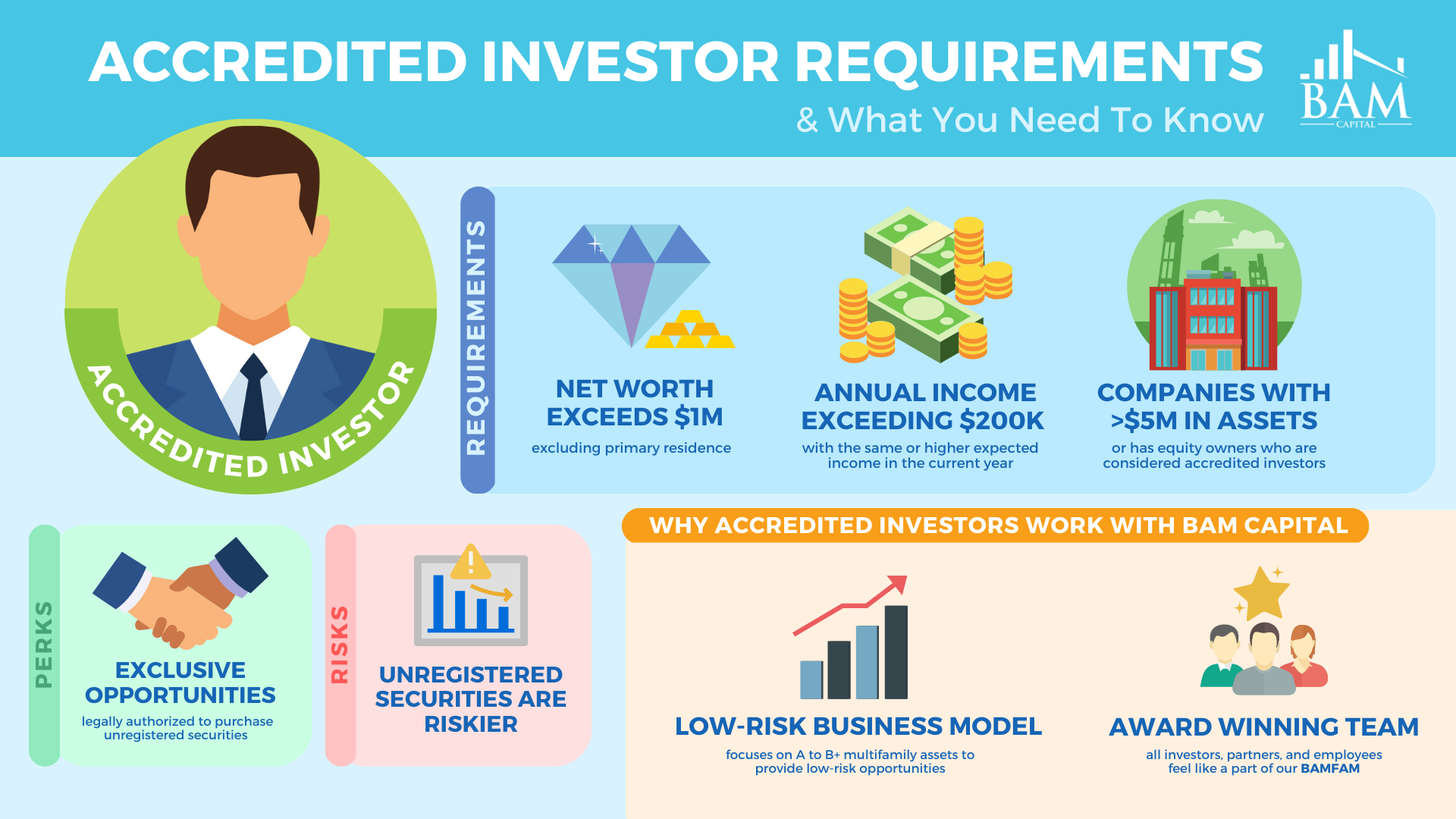

The SEC governs the guidelines for dealing safeties consisting of when and exactly how safety and securities or offerings must be registered with the SEC and what kinds of investors can join a particular offering - commercial real estate for accredited investors. As an on-line business realty spending marketplace, all of our financial investment chances are readily available just to approved financiers

In other words, you're an accredited investor if: OR ORYou are an owner in good standing of the Collection 7, Series 65, or Series 82 licenses A certified investor doesn't have to be a specific person; trusts, particular pension, and LLCs might additionally get approved for accredited investor status. Each investing capacity might have somewhat different standards to be thought about recognized, and this flowchart details the certification criteria for all entity types.

Within the 'certification verification' tab of your, you will certainly be provided the complying with alternatives. Upload financials and documentation to reveal proof of your recognized condition based upon the requirements summed up above. proving to your status as an accredited financier. The uploaded letter has to: Be authorized and dated by a qualified third-party; AND Clearly mention the companies qualifications (ex, "I am a signed up certified public accountant in the State of [], certificate #"); AND clearly state that the investor/entity is an accredited capitalist (as defined by Policy 501a).

Innovative Growth Opportunities For Accredited Investors

Please note that third-party letters are only legitimate for 90 days from day of issuance. Per SEC Policy 230.506(c)( 2 )(C), prior to accepting an investor right into an offering, sponsors must obtain written proof of a capitalist's certification status from a certified third-party. If a third-party letter is given, this will certainly be passed to the sponsor directly and needs to be dated within the previous 90 days.

After a year, we will certainly need upgraded monetary documents for testimonial. To learn more on recognized investing, see our Accreditation Introduction posts in our Aid Center.

The test is anticipated to be readily available at some time in mid to late 2024. The Equal Opportunity for All Investors Act has already taken a substantial action by passing your house of Representatives with an overwhelming ballot of support (383-18). accredited investor funding opportunities. The next stage in the legal procedure involves the Act being reviewed and elected upon in the Us senate

Effective Alternative Investments For Accredited Investors

Given the speed that it is moving already, this might be in the coming months. While exact timelines are unsure, offered the considerable bipartisan backing behind this Act, it is expected to proceed via the legal process with relative speed. Presuming the one-year window is offered and achieved, implies the message would be readily available at some point in mid to late 2024.

For the average investor, the financial landscape can sometimes feel like a complicated labyrinth with minimal accessibility to specific investment opportunities. A lot of investors don't certify for accredited financier condition due to high revenue level needs.

Proven Passive Income For Accredited Investors Near Me

Join us as we demystify the world of certified investors, untangling the significance, requirements, and potential advantages connected with this classification. Whether you're brand-new to spending or seeking to expand your economic perspectives, we'll clarify what it indicates to be a recognized capitalist. While services and banks can receive recognized financial investments, for the purposes of this article, we'll be reviewing what it implies to be a recognized capitalist as a person.

Personal equity is additionally an illiquid property class that looks for long-term appreciation far from public markets. 3 Private positionings are sales of equity or financial obligation settings to professional capitalists and establishments. This kind of financial investment frequently works as a choice to various other techniques that might be required to increase funding.

7,8 There are numerous downsides when considering an investment as an approved capitalist. 2 The investment lorries offered to certified financiers typically have high investment needs.

A performance cost is paid based on returns on an investment and can range as high as 15% to 20%. 9 Numerous approved financial investment cars aren't conveniently made fluid must the demand arise.

Affordable Accredited Property Investment – Minneapolis 55401 MN

The information in this product is not intended as tax obligation or lawful advice. It may not be made use of for the purpose of avoiding any government tax obligation charges. Please consult legal or tax obligation professionals for certain information regarding your specific situation. This product was created and generated by FMG Collection to offer information on a subject that may be of interest.

The point of views expressed and material provided are for general info, and should not be thought about a solicitation for the purchase or sale of any protection. Copyright FMG Suite.

Recognized financiers consist of high-net-worth individuals, financial institutions, insurance coverage firms, brokers, and depends on. Approved capitalists are defined by the SEC as certified to spend in complicated or sophisticated sorts of safeties that are not closely controlled. Certain criteria should be met, such as having a typical yearly earnings over $200,000 ($300,000 with a spouse or cohabitant) or working in the financial industry.

Unregistered safeties are naturally riskier because they lack the typical disclosure needs that include SEC registration. Investopedia/ Katie Kerpel Accredited financiers have blessed access to pre-IPO companies, endeavor funding firms, hedge funds, angel financial investments, and numerous bargains involving facility and higher-risk financial investments and tools. A company that is seeking to elevate a round of financing might decide to straight come close to certified financiers.

Leading Tax-advantaged Investments For Accredited Investors Near Me

It is not a public business however intends to launch an initial public offering (IPO) in the future. Such a firm could choose to offer safety and securities to certified financiers straight. This type of share offering is described as a personal placement. For recognized financiers, there is a high possibility for risk or benefit.

The regulations for recognized financiers vary amongst jurisdictions. In the U.S, the definition of an approved investor is put forth by the SEC in Regulation 501 of Guideline D. To be a recognized financier, an individual has to have a yearly revenue surpassing $200,000 ($300,000 for joint income) for the last 2 years with the assumption of gaining the exact same or a higher revenue in the present year.

An accredited financier must have a net worth going beyond $1 million, either separately or collectively with a spouse. This quantity can not include a main home. The SEC additionally takes into consideration applicants to be approved investors if they are basic partners, executive policemans, or directors of a company that is issuing non listed securities.

If an entity consists of equity owners that are certified capitalists, the entity itself is a certified investor. Nevertheless, an organization can not be formed with the sole function of buying particular safeties. An individual can qualify as an accredited financier by demonstrating enough education and learning or work experience in the monetary industry.

Latest Posts

Is Tax Lien Investing Profitable

How To Buy Tax Delinquent Properties

Tax Sales Foreclosure